Knowing When It’s Time To Hire A Lawyer

Finding the best lawyer can be nerve-wracking. Because of all the lawyers who want you, it can be difficult to determine which ones are good for you. This article is filled with tips that will help you find a great lawyer.

If someone accuses you of committing a serious crime, you should hire an attorney as soon as possible. Try not to do anything by yourself, since this may mean you’re breaking the law. Attorneys have the necessary experience to handle any issue that may arise.

While being faced with the higher costs of a lawyer who specializes in the …

There is a huge demand of the services of a business attorney. There are a lot of people who are dealing with all types of settlements and debt obligations wherein there are borrowers who fail to comply with the agreement. When a person borrows money from a lender, the lender for security purposes asks for collateral. These collaterals are commonly found in the form of properties such as houses or real estate properties.

There is a huge demand of the services of a business attorney. There are a lot of people who are dealing with all types of settlements and debt obligations wherein there are borrowers who fail to comply with the agreement. When a person borrows money from a lender, the lender for security purposes asks for collateral. These collaterals are commonly found in the form of properties such as houses or real estate properties. It is definitely the responsibility of each and every person to pay for their taxes. Then again, the current economic downturn during the past years had tremendously damaged the capability of individuals to pay extra for their taxations on time; therefore bringing on built up tax debts. For anyone who is likewise within the exact identical predicament, it is time to contemplate about the most beneficial IRS tax debt relief package which will do the job.

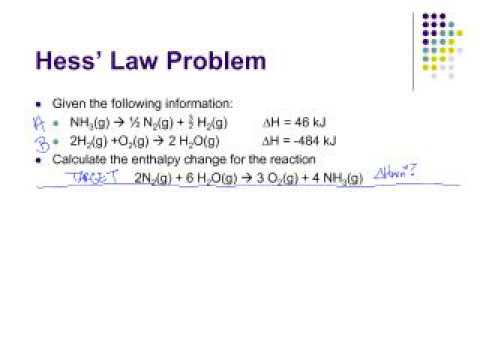

It is definitely the responsibility of each and every person to pay for their taxes. Then again, the current economic downturn during the past years had tremendously damaged the capability of individuals to pay extra for their taxations on time; therefore bringing on built up tax debts. For anyone who is likewise within the exact identical predicament, it is time to contemplate about the most beneficial IRS tax debt relief package which will do the job. Tax preparation is not simple or easy. Too many people choose to do their own personal tax preparation without the proper knowledge of tax code and/or a familiarity of recent tax code changes. In addition, even CPA’s and other IRS professionals very often make costly errors due to a failure of staying abreast of ever changing tax laws and failure to address minor yet very important things in regards to the details.

Tax preparation is not simple or easy. Too many people choose to do their own personal tax preparation without the proper knowledge of tax code and/or a familiarity of recent tax code changes. In addition, even CPA’s and other IRS professionals very often make costly errors due to a failure of staying abreast of ever changing tax laws and failure to address minor yet very important things in regards to the details. As the personal financial situations of individuals all across America decline with the economic conditions, many people are considering bankruptcy as a legitimate option to ending a financial nightmare. Filing for personal bankruptcy is a huge decision. A very complex process, it has long-term effects that some people don’t fully understand. Unfortunately, most people who file for bankruptcy aren’t aware of the other available options.

As the personal financial situations of individuals all across America decline with the economic conditions, many people are considering bankruptcy as a legitimate option to ending a financial nightmare. Filing for personal bankruptcy is a huge decision. A very complex process, it has long-term effects that some people don’t fully understand. Unfortunately, most people who file for bankruptcy aren’t aware of the other available options. Anytime you are involved in an accident that causes an injury to you, or a member of your family, you should contact a Personal Injury Lawyer. They specialize in helping people get the compensation they deserve for an injury caused by negligence, recklessness, or caused deliberately. They cover a wide range of accident types including, but not limited to:

Anytime you are involved in an accident that causes an injury to you, or a member of your family, you should contact a Personal Injury Lawyer. They specialize in helping people get the compensation they deserve for an injury caused by negligence, recklessness, or caused deliberately. They cover a wide range of accident types including, but not limited to: A personal injury lawyer specializes in providing legal guidance and representation to those who are facing some level of loss due to the actions or inactions of another person. This type of legal help is often necessary because individuals may not realize they have a case or they have no idea how much compensation they deserve. In cases of medical malpractice, it can be incredibly difficult for individuals to go up against powerful hospitals and insurance companies to prove their case. That is when having an attorney working for you can be very beneficial.

A personal injury lawyer specializes in providing legal guidance and representation to those who are facing some level of loss due to the actions or inactions of another person. This type of legal help is often necessary because individuals may not realize they have a case or they have no idea how much compensation they deserve. In cases of medical malpractice, it can be incredibly difficult for individuals to go up against powerful hospitals and insurance companies to prove their case. That is when having an attorney working for you can be very beneficial. If you find yourself charged with criminal tax evasion you will need to hire an attorney but not just any attorney a criminal tax attorney. It is better to get such an attorney opposed to getting a tax attorney as a criminal tax attorney specializes in criminal tax cases and will have the expertise necessary to help you. It doesn’t matter what type of tax crime you have been charged with, it will not be taken lightly by the courts and if you go into court by …

If you find yourself charged with criminal tax evasion you will need to hire an attorney but not just any attorney a criminal tax attorney. It is better to get such an attorney opposed to getting a tax attorney as a criminal tax attorney specializes in criminal tax cases and will have the expertise necessary to help you. It doesn’t matter what type of tax crime you have been charged with, it will not be taken lightly by the courts and if you go into court by … Everyone has to file their taxes and it is mandatory that you file your taxes for the previous year in the current year. For anyone who has filed taxes must know that it takes a lot of time and energy if one has to visit the tax department. So an easy way to file your tax return for free without any hassles or extra charges is the new e-filing or electronic filing. This method of filing taxes is stress free and even if you had no experience with filing taxes, still you …

Everyone has to file their taxes and it is mandatory that you file your taxes for the previous year in the current year. For anyone who has filed taxes must know that it takes a lot of time and energy if one has to visit the tax department. So an easy way to file your tax return for free without any hassles or extra charges is the new e-filing or electronic filing. This method of filing taxes is stress free and even if you had no experience with filing taxes, still you …