The Rise of Mobile and Contactless Payments

The way we pay for things has undergone a dramatic shift in recent years. Gone are the days when cash reigned supreme. Now, mobile wallets like Apple Pay and Google Pay, along with contactless credit and debit cards, are rapidly becoming the norm. This shift is driven by convenience and a growing desire for speedier transactions, particularly for smaller purchases. The simplicity of tapping your phone or card against a reader has made these methods incredibly popular, especially among younger generations who have grown up with this technology. This seamless integration into daily life makes it easier than ever to make payments, fostering wider adoption.

Enhanced Security Features Protecting Your Transactions

Security concerns were initially a major hurdle for the widespread adoption of digital payments. However, next-gen payment processing has significantly advanced security measures. Tokenization, for example, replaces sensitive card details with unique tokens, protecting your actual account information. Biometric authentication, such as fingerprint or facial recognition, adds another layer of protection, making it significantly more difficult for unauthorized individuals to access your funds. Advanced fraud detection systems constantly monitor transactions for suspicious activity, flagging potential issues in real-time. These advancements are crucial in building trust and ensuring users feel safe using these new methods.

Streamlined Checkout Experiences for a Smoother Process

Frustrating checkout processes can be a major deterrent to online shopping. Next-gen payment processing aims to eliminate these pain points by streamlining the entire experience. One-click checkout options allow users to complete purchases with minimal effort, remembering payment and delivery details for future transactions. Integrated payment gateways seamlessly blend into e-commerce platforms, ensuring a cohesive and user-friendly shopping journey. This focus on simplification and speed significantly increases customer satisfaction and reduces cart abandonment rates, a critical factor for online businesses.

The Growing Importance of Data Analytics and Personalization

The vast amounts of data generated by digital payments provide invaluable insights for both businesses and consumers. Sophisticated analytics tools can identify spending patterns, helping businesses understand customer preferences and personalize their offerings. This data can be used to tailor marketing campaigns, optimize pricing strategies, and develop more targeted product recommendations. For consumers, this can translate to more relevant offers and a more personalized shopping experience, further enhancing the overall payment process and customer loyalty.

The Expansion of Payment Options for Global Reach

Globalization has created a need for more flexible and inclusive payment options. Next-gen payment processing is responding to this demand by supporting a wider array of payment methods, including local digital wallets and alternative payment systems popular in different regions. This increased versatility allows businesses to reach a broader global customer base, breaking down geographical barriers and fostering international trade. This inclusivity also ensures a smoother experience for customers regardless of their location or preferred payment method.

The Future of Payments: Emerging Technologies and Trends

The evolution of payment processing is far from over. Innovations such as blockchain technology, cryptocurrency integration, and the rise of buy-now-pay-later (BNPL) services are reshaping the landscape. Blockchain offers enhanced security and transparency, while cryptocurrencies are gaining wider acceptance as a payment method. BNPL options offer consumers greater flexibility and purchasing power, although they also introduce new considerations regarding debt management. Keeping up with these emerging trends is essential for both businesses and consumers to leverage the latest advancements and adapt to the ever-changing world of digital payments.

Improved Accessibility for a More Inclusive System

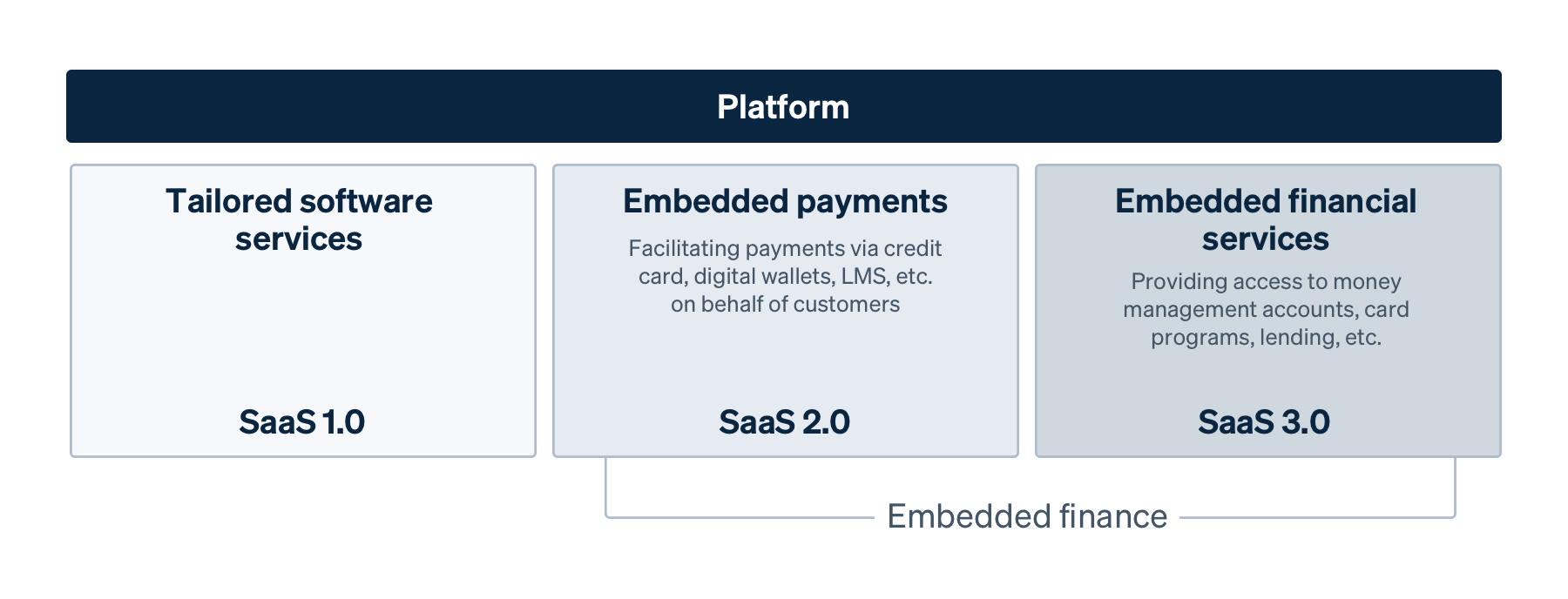

Next-gen payment systems strive for greater inclusivity. This includes features designed to improve accessibility for people with disabilities. For instance, voice-activated payment systems and simplified interfaces cater to users with visual or motor impairments. The emphasis on creating more user-friendly and accessible systems underscores the commitment to ensuring that everyone can benefit from the convenience and security of modern payment technologies, regardless of their individual needs or abilities. This focus reflects a wider societal shift towards a more equitable and inclusive technological landscape. Learn more about payment provider SaaS platforms here.