Navigating Benefits: The Essence of ERISA Law

In the intricate world of employee benefits and retirement plans, the Employee Retirement Income Security Act, commonly known as ERISA, stands as a cornerstone of legal regulation. Let’s delve into the essence of ERISA law, understanding its impact on employee benefits, retirement plans, and the overall landscape of workplace financial security.

Defining ERISA: Safeguarding Employee Benefits

ERISA, enacted in 1974, was designed to safeguard the interests of employees participating in employer-sponsored benefit plans. These plans encompass a broad spectrum, including health insurance, retirement plans, and other welfare benefits. ERISA sets forth standards for plan administration, disclosure of information, and fiduciary responsibilities, creating a framework for fair and transparent management.

ERISA and Retirement Plans: Ensuring Financial Security

One of the significant realms governed by ERISA is retirement plans. The law outlines the responsibilities of plan sponsors and fiduciaries in managing pension and 401(k) plans, aiming to ensure the financial security of employees during their retirement years. ERISA establishes rules for contributions, vesting, funding, and disclosure, creating a structured approach to retirement planning.

Health and Welfare Benefits: Comprehensive Coverage

ERISA’s impact extends beyond retirement plans to health and welfare benefits. The law outlines requirements for health insurance, disability benefits, life insurance, and other welfare benefit plans. By establishing standards for plan design, disclosure, and claims procedures, ERISA strives to guarantee comprehensive coverage and fair treatment for employees.

Fiduciary Duties: The Core of ERISA Oversight

Central to ERISA’s regulatory framework are fiduciary duties. Plan sponsors and administrators are designated as fiduciaries, entrusted with the responsibility to act in the best interests of plan participants and beneficiaries. This includes prudently managing plan assets, adhering to the terms of the plan, and ensuring transparency in communication. Fiduciary duties form the core of ERISA’s oversight mechanism.

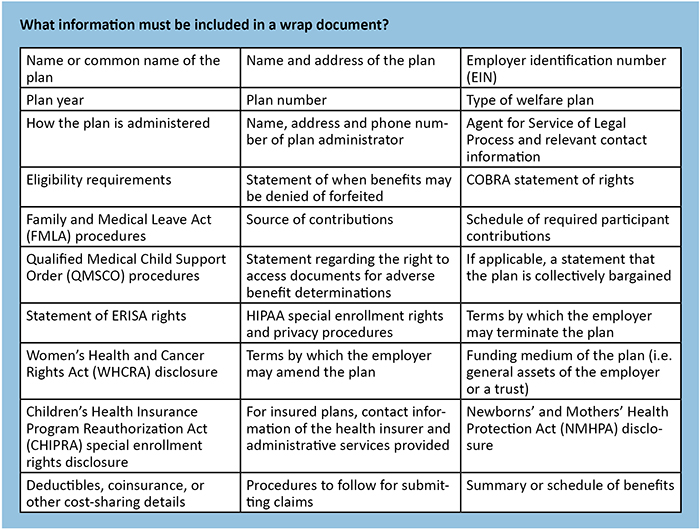

ERISA Law and Plan Administration: Ensuring Compliance

ERISA establishes stringent guidelines for plan administration, aiming to ensure compliance with the law and protect the rights of participants. From providing detailed plan information to participants to establishing procedures for handling benefit claims and appeals, ERISA sets the standards that govern the day-to-day operations of benefit plans.

Navigating ERISA Compliance: RhythmsOfManipur.com’s Guidance

For those navigating the complexities of ERISA compliance, RhythmsOfManipur.com offers a wealth of resources. Dive into the website to explore articles and insights that demystify the intricacies of ERISA law, providing valuable guidance for employers, plan sponsors, and individuals seeking to understand and adhere to ERISA standards.

ERISA Litigation: Addressing Disputes and Challenges

In the event of disputes or challenges related to benefit plans, ERISA provides a framework for litigation. The law establishes procedures for participants to file claims and pursue legal remedies when their rights are violated. ERISA litigation addresses issues such as denial of benefits, breach of fiduciary duties, and other matters that may arise during the administration of benefit plans.

Updates and Amendments: Adapting to Changing Needs

ERISA recognizes the dynamic nature of the employment landscape and benefits needs. The law allows for updates and amendments to benefit plans to adapt to changing circumstances and requirements. This flexibility ensures that benefit plans remain relevant and effective in meeting the evolving needs of employees.

ERISA’s Impact on Employee Rights and Protections

Beyond its regulatory framework, ERISA has a profound impact on the rights and protections afforded to employees. By establishing standards for disclosure, transparency, and fair treatment, ERISA contributes to a workplace environment where employees can make informed decisions about their benefits and financial security.

Embark on a journey through the realms of employee benefits and retirement plans, where ERISA law serves as a guiding force. By understanding its essence and adhering to its principles, employers and employees alike navigate a landscape of financial security, transparency, and fair treatment, fostering a workplace environment where the essence of ERISA resonates in the fabric of employee well-being.