Malta’s Virtual Financial Assets Act: A New Regulatory Framework

Malta has been a pioneer in blockchain and cryptocurrency regulation, aiming to create a robust yet adaptable legal framework. The Virtual Financial Assets Act (VFAA) is the cornerstone of this approach. It doesn’t just regulate cryptocurrencies; it addresses a wider range of virtual financial assets, encompassing tokens representing equities, debt instruments, or other forms of value. This broad scope aims to cover future innovations within the digital asset landscape.

Licensing and Registration for Crypto Businesses

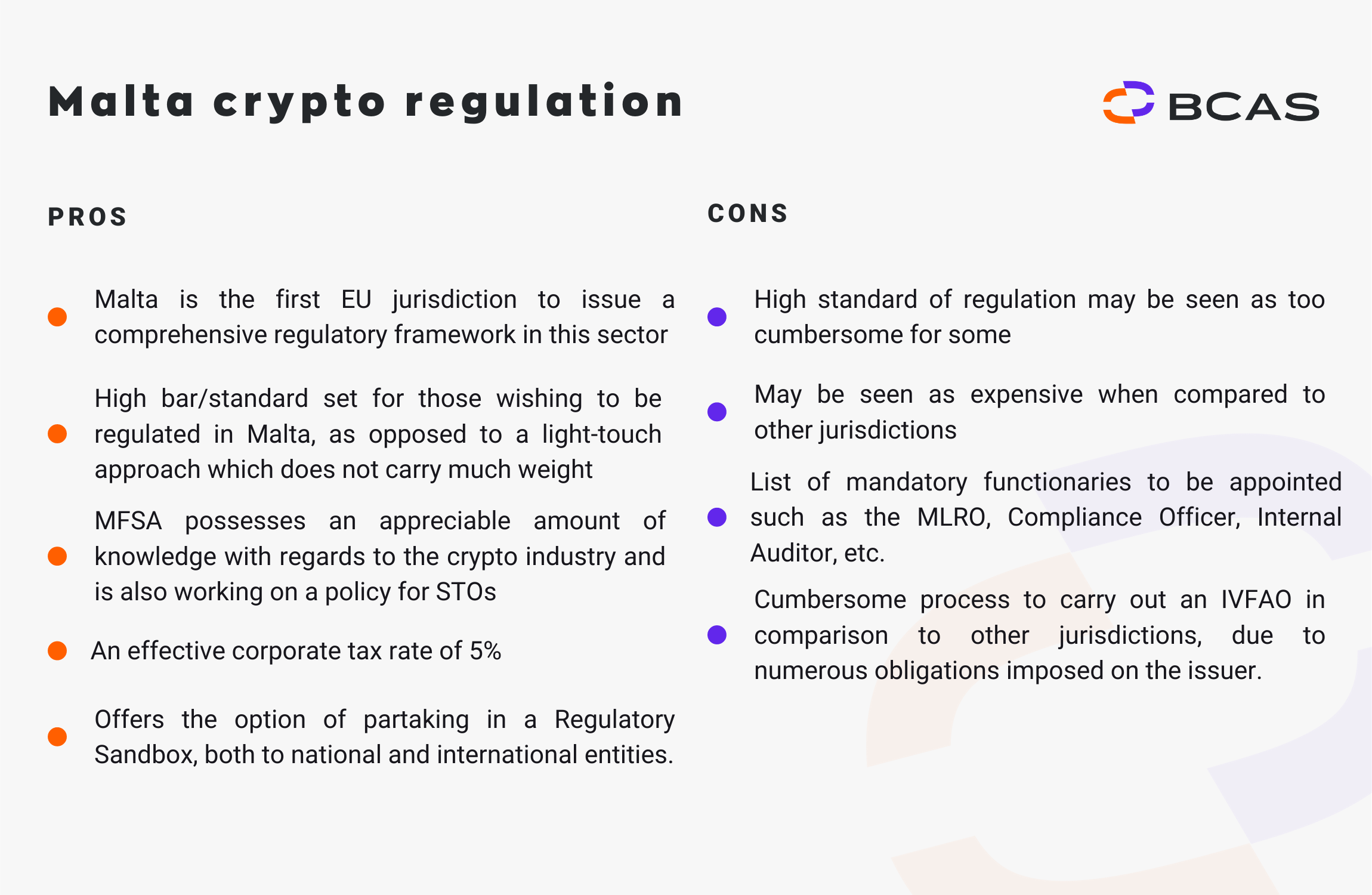

Operating a cryptocurrency business in Malta requires obtaining the appropriate license under the VFAA. This licensing process involves a rigorous vetting procedure, ensuring that companies meet specific anti-money laundering (AML) and know-your-customer (KYC) standards. Different licenses cater to different activities, such as cryptocurrency exchanges, custodians, or Initial Coin Offering (ICO) platforms. The licensing structure is designed to promote transparency and protect investors. Obtaining a license is a significant undertaking, requiring detailed applications and ongoing compliance obligations.

Focus on Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance

AML and KYC compliance are paramount under Malta’s new crypto regulations. The VFAA mandates stringent measures to prevent money laundering and terrorist financing. Licensed businesses must implement robust systems for identifying and verifying their clients’ identities, monitoring transactions for suspicious activity, and reporting any irregularities to the relevant authorities. Failure to comply with these regulations can result in severe penalties, including license revocation and legal action.

The Role of the Malta Financial Services Authority (MFSA)

The MFSA plays a central role in overseeing the cryptocurrency industry in Malta. It’s responsible for issuing licenses, monitoring compliance, and enforcing the VFAA. The MFSA’s involvement provides a level of regulatory certainty, attracting both established players and startups to the Maltese jurisdiction. The authority’s proactive approach to regulation is seen as crucial for fostering innovation while mitigating risk.

Taxation of Crypto Assets in Malta

Malta’s taxation of crypto assets is a complex area that requires careful consideration. While there isn’t a specific “crypto tax,” the general principles of Maltese tax law apply. Profits from cryptocurrency trading are generally considered income and are subject to income tax. Capital gains tax may also apply depending on the specific circumstances. It’s vital for businesses and individuals dealing with cryptocurrencies in Malta to seek professional tax advice to ensure compliance.

Investor Protection Under the VFAA

The VFAA includes provisions aimed at protecting investors in the cryptocurrency market. This includes measures to prevent market manipulation, promote transparency in financial reporting, and ensure the security of digital assets held by licensed entities. These investor protection measures are designed to build trust and confidence in Malta’s cryptocurrency ecosystem.

The Future of Crypto Regulation in Malta

Malta’s regulatory framework is constantly evolving to adapt to the dynamic nature of the cryptocurrency industry. The MFSA actively monitors technological advancements and market trends to ensure that the VFAA remains relevant and effective. Malta’s commitment to proactive regulation positions it as a potential leader in establishing global standards for the responsible development of the cryptocurrency sector. This ongoing evolution underscores Malta’s dedication to fostering a secure and innovative cryptocurrency ecosystem.

Challenges and Criticisms of Malta’s Approach

Despite its progressive approach, Malta’s regulatory framework has faced some challenges and criticisms. The complexity of the VFAA has been cited as a hurdle for smaller businesses, and the cost of obtaining a license can be significant. Concerns have also been raised regarding the effectiveness of enforcement and the speed of regulatory response to rapidly evolving market conditions. Addressing these challenges will be crucial for maintaining Malta’s position as a leading jurisdiction for cryptocurrency businesses.

Comparing Malta’s Approach to Other Jurisdictions

Malta’s regulatory approach differs significantly from that of many other countries. Some jurisdictions have taken a more cautious approach, with outright bans or limited recognition of cryptocurrencies. Others have adopted a more laissez-faire attitude, leading to a less regulated market. Malta’s attempt to balance innovation with robust regulation represents a unique and potentially influential model for other nations grappling with the challenges of regulating the cryptocurrency sector. Visit this link for information about Malta cryptocurrency regulation.